My September CON poll lead bet a looking a bit sick – politicalbetting.com

My September CON poll lead bet a looking a bit sick – politicalbetting.com

My September CON poll lead bet a looking a bit sick – politicalbetting.com

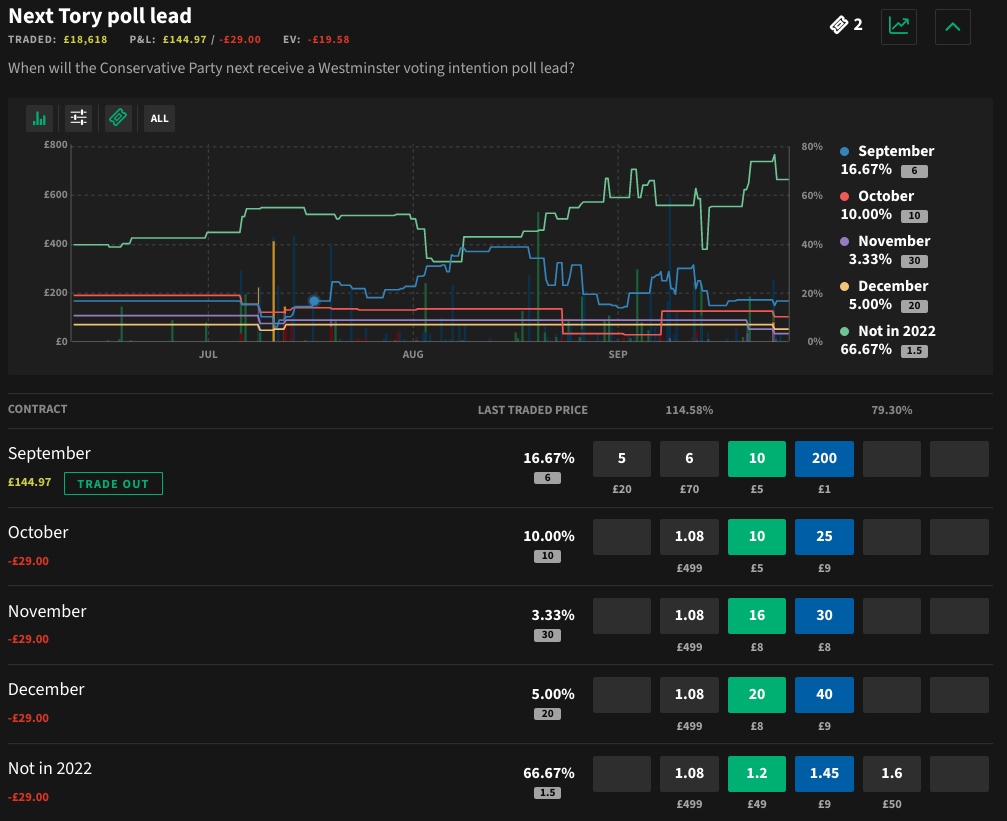

Regular PBers will recall that back in July I was suggesting that a Tory poll lead in September was a likely possibility because the new leader would get a bounce. The contest finished on September 5th and there was plenty of time I reasoned during the month for just one poll to put the Tories over the line

0

This discussion has been closed.

Comments

The mini budget is what has destroyed things totally - look at the fact we are now discussing if Truss lasts until January....

Honestly, that mini-budget on Friday was worse for what it didn't talk about over what it did.

"I hereby re-confirm the inflation target as 2 per cent as measured by the 12-month

increase in the Consumer Prices Index (CPI). The inflation target of 2 per cent is symmetric

and applies at all times. This reflects the primacy of price stability and the forward-looking

inflation target in the UK monetary policy framework. The government’s commitment to

price stability, and the Bank of England’s operational independence remains absolute."

Nothing about You can only make decisions every 6 weeks.

And the Chancellor is clearly happy for this disaster to occur for reasons.....

What better show for the Commonwealth than King Charles III sacking Liz Truss and appointing a Canadian as part of the new government?

I reckon he would outlast Bonar Law.

The major lesson from all this is ego and ideology is ultimately bad for business. Who knew? 🤷♀️

"Modern monetary theory has been taken into a corner by the bond markets and beaten up."

The change in cable this year is considerably less than it was in eg 2008, even with the flight to dollar and the Fed being far more aggressive with rate rises than the BoE.

A floating currency floating to appropriate rates isn't a disaster.

https://twitter.com/TheSecondBag/status/1574313640643149824

Replying to

@faisalislam

And the pain you feel on the UK is affecting all of us who retired elsewhere. The Eastern Caribbean dollar is dropping to parity and our bills and food costs are getting higher. We are suffering through exchange rate devaluation

"Investors 'inclined to regard Conservative Party as a doomsday cult', says analyst

Investors seem inclined to regard the UK Conservative Party as a doomsday cult, according to Paul Donovan, chief economist of UBS Global Wealth Management."

https://www.theguardian.com/business/live/2022/sep/26/sterling-record-low-tax-cuts-investors-kwarteng-truss-ftse-stock-markets-business-live 09:14

So Truss comes to see His Majesty. He queries the calamity going on in the markets. She dismisses them, he says "no, hang on, you can't just ignore this"

House of Cards fans may recall To Play The King. New King enters almost immediate constitutional crisis by clashing with a government doing egregious stupid...

I still have a lot of time for my MP, who has the right instincts - and needs to be in the mix to remedy the mistakes of the Liz Truss premiership. I would likely vote for him personally. But if those of the top of the Party were still acting in a way that I thought was not in the best interests of the country, I would be torn between voting for him and sitting on my hands.

"A gunman has opened fire at a school in central Russia, killing at least six people and injuring twenty, Russian officials say."

https://www.bbc.co.uk/news/world-europe-63032790

File under never going to happen.

The appropriate rate for cable last week was $1.15 to £.

The appropriate rate today is somewhere between $1.08 and $1.03

So even using your own argument it doesn't make any sense - the "mini budget" has changed the appropriate rate into 1 that is 6-10% lower than it was last week...

Your yacht's flat on its side, your rudder's floating away, your radio's dead and there's a howling on-shore gale with a tide race behind it. But you've still got the mainsheet in your hand. Do you pull it in or let it out?

Bailey's dilemma.

The pound had now reached its lowest level ever against the US dollar. This suggests that the British economy is at its weakest relative to the US economy ever. That's not a good outcome.

1. A weak pound affects inflation and the cost of living.

2. The cost of servicing our debt has gone up. That is money which could be spent elsewhere more productively being wasted on servicing a debt run up for purposes which do little or nothing to deal with the reasons why Britain has low growth.

3. A weak pound might normally help exporters but we have made that more difficult for ourselves by increasing barriers to trade with one of the biggest markets on our doorstep.

A stable sensible government with a clear well-thought out and broadly financially literate economic policy is essential for long-term investment. Anyone looking at the politics of Britain in the last few years is not seeing that.

I remember saying early in the summer that priority one for the incoming Rishi/Liz government was to win market credibility with targeted tax cuts for growth and spending cuts to balance the budget because we, as a nation, need to sell ~£250bn worth of new gilts over the next two years plus roll over another £150bn and the BoE won't be driving up gilt prices. In fact it's worse because now we need to sell £350bn in new gilts, roll over £150bn and the BoE is selling £80bn, so over two years we need markets to finance the UK economy to the tune of £580bn, it's an absolutely gigantic ask for a nation running a 5-6% current account deficit and no plan to reduce it and a a 7.5% current budget deficit and no plan to reduce it.

The Liz/Kwasi government has done precisely the opposite and now we, as a nation, face financial ruin as the market calls time on lending at reasonable rates.

So yes $1.12 to $1.08 is a 3.5% change but that sort of variance is quite standard not extraordinary, in 2008 there was a change from $2 to $1.40 so a 30% change. Comparable would be us going to roughly £1 = 80 cents now.

https://twitter.com/jessicaelgot/status/1574314808635260931?s=20&t=tJ1w_WkXXAoZchkuu37xGQ

.

There is no other mechanism to bring about an earlier GE

The shipping freight indexes indicate inflation is likely cooling.

Set against that, we could be on track for a zombie government led by a millenial cult who have two years and a seventy seat majority to play with. That couldn't be allowed to happen- could it?

Immovable object, meet irresistible force.

Should I go long or short?

The stated strategy is to boost growth and a more competitive exchange rate helps that.

Now the strategy can be criticised as can the individual tax changes but Britain is now in a better position to get foreign investment and foreign tourists while boosting exports and import substitution.

Thanks to Covid the railways are already nationalised in all but name and the companies with least problems LNER is directly under government control.

Nationalising them allows the railways to be restructured into say a sane logic..

"Information appeared on the network that a military commissar was shot dead in the Ust-Ilim Military Commissariat (Irkutsk region)."

I can see more of this happening. Russian recruitment offices have been firebombed since the start of the war; I'm unsurprised some are taking it further.

Edit:

"Map of arson of military registration and enlistment offices and administrations in Russia in two days"

https://twitter.com/andischl/status/1573763665874092035

Italy, likely FPTP final seat count (+/-1 on top 3):

Right bloc: 121

Left bloc; 12

M5S: 10

Sudtirol Volksparty: 2

Aostans: 1

Sud chiama Nord: 1

245 proportional seats and 8 expatriate seats still to apportion.

Politically interesting if it causes problems because DeSantis's response could influence the next GOP presidential primaries. So far he's doing the right things like mobilising the national guard and working constructively with the federal govt (though the latter might be seen as a handicap by MAGA types).

I've made this point repeatedly before, in the 80s Thatcher famously said about the EEC Single Market that it would be a market "bigger than the United States" which was true at that time. The EEC was much bigger than the United States.

However since then, the US has gone from strength to strength, while Europe has floundered and hit the rocks.

The EU (even post expansion) and the UK combined are nowhere near as strong as the US.

To be honest, its a surprise the USD hasn't appreciated even more than it has, and the fact that Sterling has been overvalued for years relative to the USD is part of why we have such a massive and systemic current account deficit.

In 1988 when Thatcher made that famous speech the US GDP per capita was $5.236 trillion versus $0.91 trillion for the UK so 5.75 to 1 in size.

Its now $21 trillion versus $2.7 trillion for the UK so 7.78 to 1 in size.

The US has its own problems, don't get me wrong, but they are cultural and racial far more than economic.

The unstoppable force of the cost of living crisis is about to meet the immovable object of the inadequacy of Liz Truss. It's going to be spectacular.

There's more to the economy than materials.

https://twitter.com/lionelbarber/status/1574314545526489088

https://twitter.com/BrianSpanner1/status/1574322479828729857/photo/1

The issue is that the value we add only represents X% of the final price...

Any substitution would simply increase the added value a small bit and again doesn't really work as outside real top end premium products we still have a British Leyland type reputation for average products.

Really? You want the old “sick bet” sketch?

This bet is no more! It has ceased to be! 'Shuffled off 'is mortal coil, run down the curtain and joined the choir invisible!! Sick? Or an ex bet?

Actually, a rogue yougov or a Kantor may have been as likely than an Opinium Mike, presumably Opinium swingback runs out of former Tory don’t knows from the sample the more it uses them? yougov seems to capture volatility and excitement.

You did though point out Truss DID GET an uptick from don’t knows returning, from other pollsters too, what no one anticipated I think is how Truss appears to have strengthened Labours polling at same time as her own party’s uptick.

https://www.theguardian.com/business/live/2022/sep/26/sterling-record-low-tax-cuts-investors-kwarteng-truss-ftse-stock-markets-business-live?CMP=share_btn_tw&page=with:block-63315ebc8f0891514fe7c5f9#block-63315ebc8f0891514fe7c5f9

Perhaps I should take a trip to Birmingham in my Barnes Tory gear (blazer and red trousers). (Rapidly diminishing number of Tories in Barnes).

Yes, it won't be easy, but unless you want to file it under "too hard to handle" what else do you suggest? We aren't suddenly going to become a major raw materials exporter again, but we ought to be able to add value.

And no, services are to a great extent not importable exportable or substitutable. If I want my hair cut or my appendix removed, or to be served in a restaurant, that (not something else) needs to happen here.

Even Ian Blackford makes sense...

The salient point is markets have lost trust in the Govt. The BoE are going to have to deal with the fallout in a crisis. Interest rate moves cannot always be left to a scheduled day. If you need to act, you must do so. One thing is for sure Parliament should be sitting right now https://twitter.com/peston/status/1574311793698152448

Remember that I have talked up Sunak for a few years. He has proven to be absolutely right about Trussnomics, and had an alternative proposal with less red meat now but the promise of continuity of meat for the future. I don't like his politics but I respect his sanity and honesty.

Come on Tories. She's mad. Get rid and put Rishi in.

There are knock on effects to what you're saying.

That issue comes down to the way franchises work - towards the end there is little incentive to organise things if you aren't the next operator it's better to pocket the money and leave the mess for others to work out...

Good thing we didn´t have that coalition of chaos eh?