The great Brexit divide – Approval of Johnson and Starmer – by referendum vote and social class – po

The great Brexit divide – Approval of Johnson and Starmer – by referendum vote and social class – politicalbetting.com

The great Brexit divide – Approval of Johnson and Starmer – by referendum vote and social class – politicalbetting.com

0

This discussion has been closed.

Comments

It's all going downhill, Tory vote is collapsing!

Ish.

For example, I haven't checked whether Ireland has a similar tax, but if it doesn't would that explain why salaries are generally higher there?

Especially for gross approval instead of net approval? South East

Remain 2,391,718

Leave 2,567,965

Remain 48%, Leave 52% - same as the nationwide results.

South West

Remain 1,503,019

Leave 1,669,711

Remain 47%, Leave 53% - better than the nationwide results.

Winchester, Guildford, easy money!

Psychologically on both an individual and employer level it functions much more as @Pagan2 and @RochdalePioneers describe.

The meta effect may well be one of wage depression as you point out.

Labour aren't the only party at risk of listening only to people in their bubble.

@BallouxFrancois

·

1h

I've often been asked when I felt the covid pandemic would be over, and have always replied around mid/late 2021. I've never felt more confident about this prediction than now.

Boris has chosen to lift lockdown at a faster pace than many voters wanted at the time, so annoying some people.

And he's kepting pinging lockdowns going, so annoying other people.

Plus cases were rising, which is annoying to others.

In a few weeks time we'll see the polling response to cases going down, pinging lockdowns being over and the lockdown having been successfully lifted without causing a feared crisis in the NHS.

Another bounce in the polls for Boris in a month's time. You heard it here first. Now or never for Starmer to get a lead this year.

If you find it easier to pretend that the government can raise taxes without affecting prices in response, then its easier to pretend ENIC is different somehow and not a payroll tax.

The biggest problem is that the government would only see about 25% of it back, leaving them with a £30bn shortfall!

https://www.telegraph.co.uk/politics/2021/07/26/vaccine-passports-plan-railroaded-despite-ministers-concerns/?utm_content=telegraph&utm_medium=Social&utm_campaign=Echobox&utm_source=Twitter#Echobox=1627330233

Salary costs end up with all kinds of quirky names and acronyms. My experience of managing "SG&A" to use one example is that the pressure is always to reduce it. Philip's example is of a one-off cut in costs thanks to the abolition of ENIC. In the real world a more realistic example is expensive salary employee leaves the business. Thanks to a smart bit of recruitment their replacement is on 70% of the salary.

The 30% saved doesn't stay in my team's SG&A for me to increase the rest of the team's wages. At best it goes into another team who need to add a head and have no budget left, or most often is taken as part of the cost reduction demand during the year.

Salary is package - offer x salary y car z pension and other totalling bang. Does that compare well in the market, can we get the person we need for that? That is the market comparison, not one where we add in employer costs. Unless Philip's greater than mine personal experience says otherwise?

IMO it’s all part of the nudge theory wound up to 11, to get the teens and twenties vaccinated.

I have been off the front of Invincible in 0 deg nozzle instead of 10 deg. A similar mistake with flaps was almost always a death sentence but I prevailed through a cloud of spray and later an artfully raised eyebrow from Cdr Air. I was shaking like Michael J. Fox shitting a penknife out for hours after. Happy days..

Hint: that warning is a lot more threatening with the tories on 38 than it is with the tories on 44.

Lets simplify this a bit - do you believe that in the end market prices respond to tax changes? Or do you think the market just absorbs tax changes without any response whatsoever to prices?

18/7 18,186 first vaccinations

25/7 24,551

We should be rapidly approaching zero first doses now.

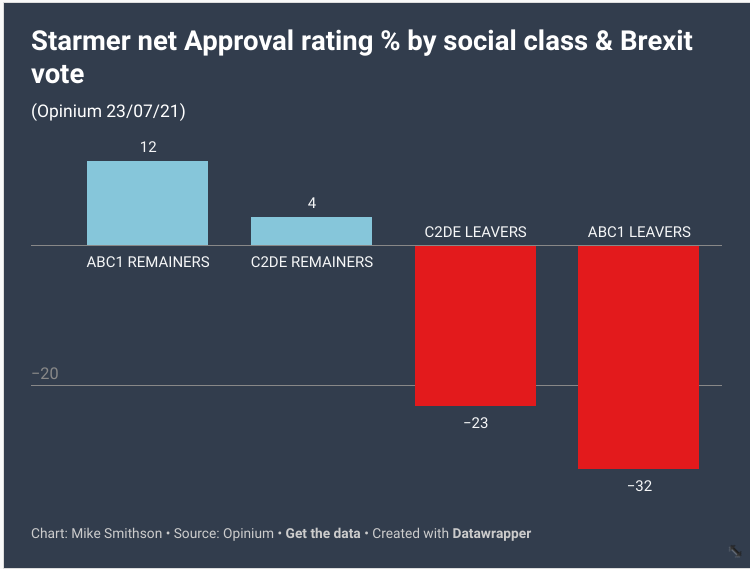

My guess is that eventually the C2DE Leavers will tire of the routine if they don't see any real improvements. So what Johnson needs now is someone he can put in charge of "Levelling-Up" who can deliver something tangible.

Is your expertise on employee budget management based (a) on your direct professional experience or (b) theory?

If it really becomes squeaky bum time with food shortages it will be interesting to see if any perceptions are changed if the shops in the EU don't seem to be similarly affected.

But it is a tax on employment.

I know nothing about (presumably Harrier) nozzles, but have seen plenty of people nearly kill themselves with incorrect flap settings or weight entered on takeoff and landing - from gliders to 747s!

Broadly speaking, we have the following total marginal rates:

- >£8k pa - employee's NI @ 12% and employer's NI @ 13.8% = 25.8% total

- >12.5k pa - base income tax @ 20% = 45.8% total

- >50k pa - higher rate income tax @ 40%, but employee's NI drops to 2% = 55.8% total

- £100k to £125k pa - lose tax-free threshold = 75.8% total

- £125k to £250k pa - tax-free threshold already lost = 55.8% total

- >£150k pa - income tax up to @ 45% = 60.8% total

For people with student loans, add perhaps another 5 to 10% onto the above.Anyone arguing that we should be increasing employment taxes needs their heads checked given how much we already do, and how little we tax wealth.

A PM can't "do" that much themselves, they can shape the big picture but whether that's developed and runs into trouble or succeeds very much depends upon others and not just the PM. One of the primary skills of a good PM is helping to identify those who can do well and put them where they're needed.

You might be able to correlate average earnings growth with other indicators, like GDP growth per capita, the unemployment rate and the inflation rate, and then you could see if average earnings growth was markedly suppressed relative to that following an increase in Employer's NI.

But I would also add on as a direct cost for workers on low incomes the effect of losing Universal Credit, if they have it. From memory that's a further 63% of their income that vanishes for every pound they earn, although since its from their post-tax wages you need to do some maths to get to the right figure.

It essentially means for base 20% income tax if somebody is on that and getting UC then for every extra pound their employer spends, HMRC gets about 90p and the employee gets about 10p.

And it is a giant con on the public.

Heck the only way to fix things properly would be to redefine, for the 21st century the current UK legal definition of employment / self employment and no one in the UK wants to do that, for there be dragons there and a lot of disappearing tax revenue.

The saving is not part of your employee's package, competitor employee's package, any benchmark at all. You insist that all of this money would be handed to employees because "market forces". Which sounds so detached from reality based on what I have seen from global blue chips right down to little SMEs that I have to wonder what industry you are in. Must be one with fabulous endless profit growth is here is no annual push to claw back unspent elements of budgets.

But, like stamp duty, it raises too much for the exchequer, so they have little choice but to double down on it.

The combination of the recovery from the pandemic, the exit from the EU, and suggestions of rapidly increasing automation, provide an ideal time to have a serious look at employment taxes - but it’s still sitting next to social care, in the “too difficult” pile for ministers.

They don't which is allowing the Government to pretend to merge 3 of them while not fixing the major issue that wide scale tax scheme promotions for greedy people who know no better.

Lockdowns and clear rules are both comprehensible and fairly popular with a large group of Tory voters who have an unfortunate propensity for authoritarianism. SFAICS a few would be quite pleased if they all went on for ever.

Obvs it and they are all bonkers, but they all vote.

The current stage has nothing in it for any of the Toryish groups. Libertarians are ATM a lost cause. Authoritarians don't like the opening up or the uncertainty. Boris is far from his best at a moment where he has to explain there are no Covid laws, except that there are, and lots more to come.

Many older Tory voters don't like either freedom or the talk of 'passports', especially if it involves digital gadgets, for some of them are less comfortable with that than they are with proper blue passports you can wave at Johnny foreigner.

And the absence of actual laws of distancing, masks etc means that everyone has to do what is right in their own eyes. Many older Tories prefer being told what to do. And they don't like the confusion in government.

So I don't think Boris's wheels have come off, but we are in for a season of confusing trench warfare for most of the rest of the year.

If true hospitalisations because of covid were bogus for all waves, for example, then the peak of hospitalisations primarily owing to covid was not more than 4,000 a day, it was actually less than two thousand a day....??

If that is the case, then the notion the NHS was going to be overwhelmed at any stage in the pandemic was one of the biggest lies ever told to the people of Britain by its own government...??

Am I missing something?

(not going for point scoring, just designing a labour 2023 election poster campaign)

https://mobile.twitter.com/bgriffiths21/status/1418250146429784067

They were told Brexit was done in the 2019 GE, that's why many voted for Johnson. Yet it's evidently not done, patience will surely run out

Trying to explain to people that HMRC's approach is one of waiting until the other side has lost the paperwork is a painful experience.

Case in point someone currently claims that HMRC has the data to fix a problem within their sector and could do it in real time when the reality is that HMRC gets the data on a delayed basis so it's 6-9 months before they have any idea something is wrong.

If you're working on a package then either your senior has already taken NI into account, or your competitors have, either way it is there.

And yes there's always push to claw back unspent elements of budgets if possible, but often its not possible because of yes for wont of a better word, market forces. Yes that includes your competitors etc too.

In a previous role I once had to renegotiate a valued colleague's salary because he was threatening to leave. I wanted to keep him. He was demanding lets say for the sake of example £100 per week extra but he was demanding it in take home pay. So whatever numbers we discussed, he was calculating tax and NI changes to see what he'd be taking home extra. I was doing the same but the other way around, adding in rather than subtracting NI changes to see how it affected my overall costs. The reality is if I can afford to pay him but not HMRC then HMRC won't turn a blind eye and ignore it, they will still demand the money they are owed.

The problem is once you look at overall costs, versus takehome pay, you can end up with very disparate results. The £100 per week extra that he wanted, would cost me much, much, much more than that.

In the end I couldn't meet his demands as I couldn't afford them. I know from acquaintances he ended up at a competitor that was paying him £100 cash in hand per week on top of his salary. That's cost them £100 cash (which no doubt has dodged VAT and other taxes too) rather than the many multiples of that you end up with once you properly account for all taxes.

At the peak the number of people in hospital, in the first wave was beyond the maximum for the hospital system. This was possible (but only just) because of heroic efforts to increase capacity.

And not so heroic efforts to dump patients out of the hospitals as fast as possible.

That is, the *actual* number of people in hospital.

No, wait, the waiting was fake as well.......

366 opinion polls that Labour led in during Neil Kinnock's time as leader between 1983 and 1992.

https://en.wikipedia.org/wiki/Opinion_polling_for_the_1987_United_Kingdom_general_election

https://en.wikipedia.org/wiki/Opinion_polling_for_the_1992_United_Kingdom_general_election

You are responsible for your tax, when HMRC come knocking for that money (and they may very well do so) I hope you are saving the 60% that you will need to pay them (HMRC will seek the employer NI from the employee in that type of case because the law says they can).

As an employee you really do want all your income tax being reported correctly via RTI PAYE, if the company goes bankrupt before the tax bill is paid HMRC doesn't have the right to go after you.

If however HMRC discovered that schemes were being used (even ones as simple as cash in hand payments) then HMRC could play a whole heap of nasty games to recover the money they want (and that money will be their estimate that you need to disprove rather than an agreed amount).

So whether it is delivered is not is not measurable by any distinct criteria different from how social change generally is measured.

What it could mean in non measurable ways is that Tories are saying they 'get' the WWC in the north (and elsewhere) is ways which politicians have failed to get. For example that aspiration doesn't only mean doing PPE at Balliol or Classics at Christ Church. An astonishing number of people (don't tell PBers) have no such aspiration, and are indifferent about those who have.

Equally aspiration for millions of WWC has nothing to to with trade union activism either. Which is one of the reasons Labour has started to the past for them and not the future, especially outside the public sector.

However I think its still the right thing to do, despite the whole pile of money. And I think tackling it properly would then see things improve so that in the long run, even the Treasury gains, since if people are losing 50-90% of their marginal income in taxes then that means they either seek to gain marginal income (which means the Treasury doesn't gain the taxes anyway, as well as harming the economy) or they engage in tax fraud or minimisation (which measn the Treasury still doesn't gain the taxes anyway).

Over the long term, I think reducing taxes from 70%+ for many brackets (eg 100k+, UC + taxes) would see the Laffer Curve work and the Treasury will regain much of those losses or even be better off as well as the taxpayers better off.

I've worked in environments where they used total cost of employment for department budgets, and ones where only salaries and some costs were counted.

I've always ensured my books are completely legit, but I know many competitors in the past have not been and only once has a competitor that I know of been tackled - and in that instance it was for their use of illegal immigration they were caught on, not the cash payments.

In other, excellent news, Wes Streeting announces he is recovered from cancer and resuming his poltiics.

Wealth is more unequal in Sweden and Germany than in the UK (higher Gini coefficient = less equal): Credit Suisse Global Wealth Databook 2021; see also https://credit-suisse.com/about-us/en/reports-research/global-wealth-report.html

https://twitter.com/JohnRentoul/status/1419943259032412163?s=20

Having said that, I think there is danger for the Tories. Gratitude among Leavers for Brexit won't last forever, and there isn't much else that Boris is liked for.

I wonder why?

That's due to uber and other apps making it impossible to hide cash payments the way they used to do so.

The care worker was alleged to have sworn back at teenage girl who had been shouting threats and hate at her non-stop.....

So process was being followed. Yes, a child died, but lessons will be learned......

Are C2DE Leavers starting to get this? It would be nice to think so, but I'm sceptical for now.

https://worldpopulationreview.com/country-rankings/gini-coefficient-by-country

Sweden 28.8, UK 34.8, USA 48

Which are still just as prevalent in many other industries that haven't become entirely online.