After the beauty parade punters make Cleverly the coming man – politicalbetting.com

After the beauty parade punters make Cleverly the coming man – politicalbetting.com

After the beauty parade punters make Cleverly the coming man – politicalbetting.com

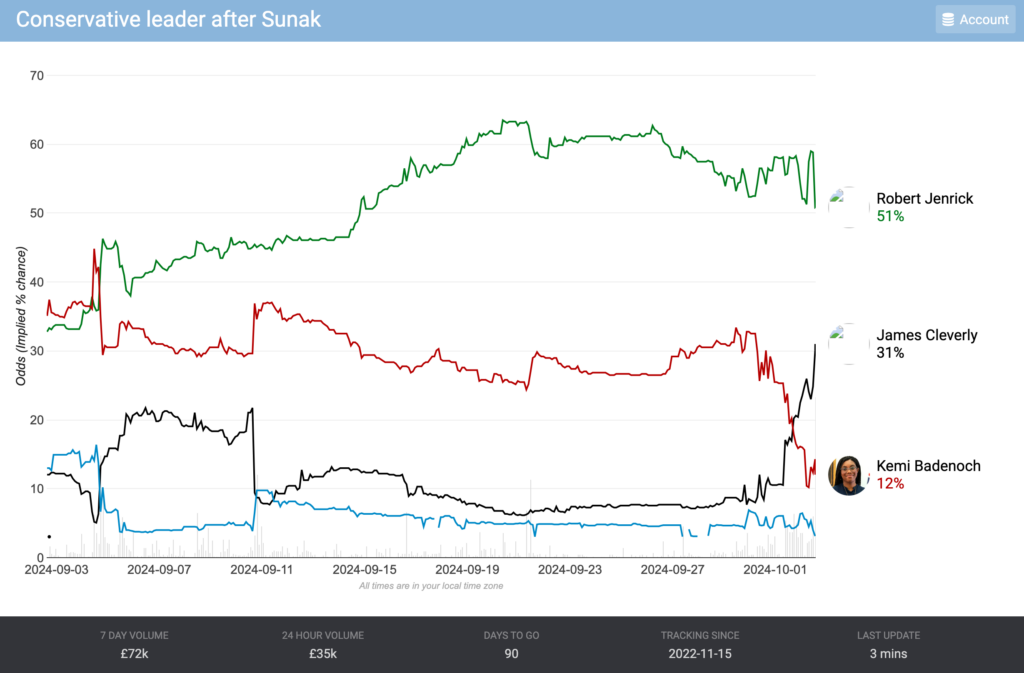

After the final four made their speeches today Kemi Badenoch continues her collapse in the betting market whilst James Cleverly has surged.

0

This discussion has been closed.

Comments

- Sort out the Party organisation, operations and finances

- Take advantage of our time in opposition to reset our direction and have a wider discussion about where we want to go as a party.

- Prepare ourselves so we're in the best possible shape for when the Government calls the next election.

But what would I know? No-one in the Conservative Party thinks any of this is necessary.

(sorry, saw the pun)

Epic fail...

Whether you like it or not the country has running costs. Defence, law and order etc and whatever else Parliament has decreed.

The country only has a finite amount of land, if you own a portion of this countries land you should pay a portion of the running costs of the country.

That's not communism it's perfectly liberal.

You seem to think "quiet enjoyment" should for some reason be taxed less than other enjoyment. I would rather let people do as they please with what they own.

Land should be taxed the same whether the owner chooses to quietly enjoy it, or chooses to work it, or chooses to build on it, or chooses to sell it and the new owner takes responsibility for paying the costs.

Why are you opposed to letting people do as they will with what they own? The state should not get involved, it should take its cut of funding for the running costs of the country but let the owner do as he, she or they pleases to do with it.

(((Dan Hodges)))

@DPJHodges

·

39m

Watched the hustings. Only one candidate looked like a serious leader and potential Prime Minister. James Cleverly. And it wasn’t really that close.

https://x.com/DPJHodges?ref_src=twsrc^google|twcamp^serp|twgr^author

https://x.com/IAPonomarenko/status/1841189919894475095

MattW is right in that you'd want to still call it council tax to help with the optics. Questions would remain about business rates (NDR in Scotland) and whether you'd make a similar change there.

But maybe it's also about a degradation of political discourse, brought about by more partisan media. Then there's the influence of foreign agents, Russia etc. deliberately injecting discord. We now know Russia was funding right-wing commentators to make divisive social media content, down to complaining the latest Star Wars series is "too woke".

Real crash and burn here.

Our current system of taxing someone who buys a flat, but not taxing someone who banks land, is utterly obscene.

I would gladly eliminate Council Tax as well as Stamp Duty at the same time as introducing a Land Tax, but the issue with calling it Council Tax is that in order to be fiscally neutral it would need to raise as much as Council Tax and Stamp Duty combined, and if you call it Council Tax then everyone should on average be seeing an increase to cover the Stamp Duty element so it will probably be deeply unpopular.

He received a lot of abuse for that but he was proven right.

Badenoch likely then goes out once Tugendhat or Cleverly's votes switch to the other

If rural land is productively used it should be able to pay for some of the costs of running the country, but I agree with it being less.

The Treasury could exempt National Trust etc land as appropriate.

If we moved as I desire to a zonal system then you can include this tax within the zonal system by taxing residentially zoned land more - and I would allow anyone who owns rural land to change their own designation if they choose to develop it to residential (while letting other rural people keep theirs if they so desire) but if they change it then they would become liable for paying the taxes as a consequence of their choice.

"Land should be taxed the same whether the owner chooses to quietly enjoy it, or chooses to work it, or chooses to build on it, or chooses to sell it and the new owner takes responsibility for paying the costs."

Ideally a LVT would have the additional benefit of discouraging people from buying agricultural land as an inheritance tax dodge, making agricultural land prices lower, and therefore agriculture more profitable.

I'll be happy when there's no housing shortage. There is one today, there is no reason why there should be though.

It is not clear the members agree with that assessment.

She has strongly-held views that mesh with the membership and expresses them. This is one of the reasons why I bet on her. But she does not understand the roles and if she fails in her attempt I think the Conservatives will have chosen wisely, at least from their POV. @MaxPB is right.

It is not clear to me that Jenrick is any better.

Whether the members agree or not is moot.

Jenrick is also harder on immigration than Kemi, while pushing building new homes and infrastructure etc

There is no demand for all the country to be housing. Prior to the introduction of the 1948 Act, land was worth only 2% of the price of a house. The actual costs of the house were the other 98%.

Land getting consent today adds 00s to the value of the land, because consent isn't automatic so it is valuable, but if you no longer needed that consent then you wouldn't add 00s to the value of the land anymore because anyone else could do so to so the value margin would collapse.

We should go back to the system we had in the 1930s, prior to the 1948 Act - farming still thrived in the 1930s but construction was at a rate that made houses affordable prior to the war.

1. Abolish income tax

2. Replace with land tax

Sensible policies for a happier Britain

The assessment is afaics on the basis of a guestimation by a clipboard-warrior as to what it could potentially be used for.

Much of the time you don't find out until you do ground research and testing as part of an outline planning application, which will cost thousands or tens of thousands.

Just after 38 mins.

https://www.youtube.com/watch?v=f0Xs-y2X4tU

They sometimes make a lorra-lorra cash from developing bits of their land.

On other other hand, you have protected areas where no development will be allowed - perhaps because of vey special newts, for example. Or perhaps there is a listed building, where no further development is possible. The development value of such land is inevitably much lower.

Their own latest favourability ratings, have him on -35, with 50% having a very unfavourable opinion of him.

The popularity ones are more "just a bit of fun", as they don't give a net figure.

And on top of that, he is just a very clever politician, who can bullshit for England, and in a very "reasonable" way, tells people their meanest instincts are actually just "very normal, and understandable".

https://yougov.co.uk/ratings/politics/popularity/politicians-political-figures/all

https://ygo-assets-websites-editorial-emea.yougov.net/documents/Favourability_and_Labour_government_actions_230924.pdf

You want a right wing leader when the conservatives need a leader that appeals across the political divide

The Conservative Party under various leaders for the past century has sought to attract the vote of liberals and not just conservatives. But HYUFD has made clear he doesn't want liberals like myself, even if we're economically right wing. Or people like you G who may have once voted for Blair in a lifetime of voting conservative.

Well now he's got his wish and the election result he wanted.

Jenrick would worry Reform, delight Labour and Lib Dems.

Cleverly would worry Lib Dems and Labour more.

Badenoch would worry Reform but also Tory MPs and CCHQ press officers.

Even though I personally dislike flats I recognise that's a matter of personal taste and accept I should pay more for owning a house than a flat, as that's my choice and I'm OK to pay for my own choices.

A significant proportion of the total land around has no or minimal real cash generative value. Because they are all the places no-one lives (a fortiori) we don't notice them or how much there is. But glance at a map of Scotland for example.

We actually like having lots of fairly relaxed space around for no special purpose except to keep bird life happy. Roseate terns don't pay tax and should not be asked to start.

OTOH London's ghastly and mis-named 'green belt' should be built on and taxed properly

Apparently it is not as cut and dried as the twat who referred to me as a "beerhall accountant" (lol) made out. Apparently other celebs/"influencers" cannot avoid paying tax on gifts that they receive through doing their job. The exemption appears to be because HMRC doesn't want to take the politicians on.

How - Frequently.

He is of the right and blue Corbynite is a fair description of him

If you have more, then that's your choice and you should pay for your choices just as I do mine.

And as was said at the start of the discussion, my proposal is not a tax hike but revenue neutral so that Stamp Duty should be eliminated so that rather than merely taxing those who are mobile people should pay lower but more consistent taxes.

Making taxes low and consistent is not a bad thing. Taxing mobility is a bad thing.

I still find this tendency to view everything on a left/right/centre perspective rather odd. There is no rule that only middle-of-the-road centrism will always carry the day.

I am if anything more centrist than most Tory members

don't see trades in the other three although fwiw I think kemi and jenrick basically right, cleverly a bit too short and I have taken some of my back of him off - I don't agree with those who say that you should always let a bet ride if you wouldn't lay - it doesn't account for fuzzy grey zones of uncertainty in your own judgement

But - I am not convinced that the person to do that is either Robert Jenrick or Kemi Badenoch. Jenrick is a bit slimy and unlikeable. Badenoch isn’t disciplined enough in her messaging.

Heath was also more centrist than Wilson when Wilson beat him in 1966 and 1974

(200+ reported injuries or deaths).

A segment from Ukraine: the Latest, yesterday:

https://youtu.be/v5rhYKmMLlk?t=67

Indeed I specifically said I'd be happy to have a zoning system so that farmers weren't being taxed as residential unless a farmer chose to change their land from agricultural zone to residential, which should be their choice but then they'd be liable for the tax as a consequence of their choice.

I am happy for farmers to have the choice what to do with their land, I'm not proposing making their choice for them.

@Richard_Tyndall mistakenly assumed it was a flat acreage charge being discussed but I and everyone else in the discussion immediately said that no the proposal is for land value not flat acreage.

Why did he not confirm RAF help for Israel ?

https://x.com/DefenceHQ/status/1841476219415466223?t=pyb74BKp0IVzt3oqqARdBQ&s=19

People don't want to know the truth; they would rather believe things that mesh with their existing prejudices.

And as media organizations are commercial businesses, built to deliver a profit to shareholders, then they will serve their audience the content they want, rather than the truth.

'Right' is capable of embracing: mass migration, zero migration, gigantic welfarism, defence cuts, cultural barbarism, cultural elitism, building houses everywhere, protecting heritage everywhere, equality of opportunity, inequality of opportunity, Oxford for toffs, Oxford for chavs, protectionism, free trade....

The govern is to choose.

Lord Alli under investigation for non registration of interests

https://news.sky.com/story/politics-latest-tory-conference-leadership-jenrick-badenoch-cleverly-tugendhat-12593360?postid=8371969#liveblog-body