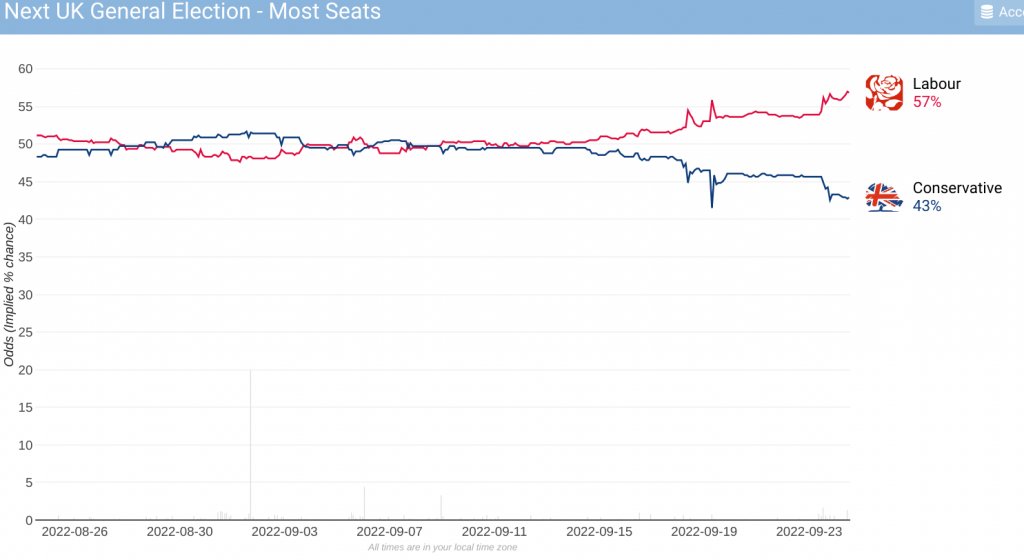

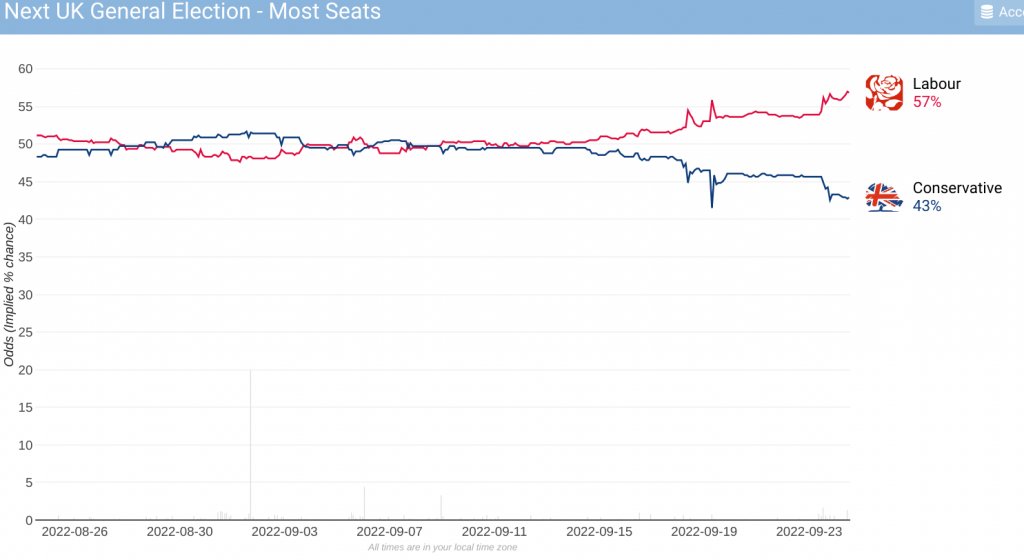

The general election betting moves to LAB since the arrival of Truss – politicalbetting.com

The general election betting moves to LAB since the arrival of Truss – politicalbetting.com

The general election betting moves to LAB since the arrival of Truss – politicalbetting.com

0

This discussion has been closed.

The general election betting moves to LAB since the arrival of Truss – politicalbetting.com

The general election betting moves to LAB since the arrival of Truss – politicalbetting.com

Comments

Defence for a start we could save a huge amount on procurement by just buying off the shelf stuff rather than creating custom shit just because.

NHS - last night I suggested a cap on lifetime health care expense, would set it at the average to start with and people can take out insurance to cover any over that. Also services such as tattoo removal should not be available. I would also refuse IVF on the NHS, a round of IVF costs about 10k....if you cant afford to save up 10k once a year to pay for it can you really afford the child as raising a child is likely to cost that a year in any case plus we have a lot of kids crying out for adoption.

I am sure others could come up with savings in all the other areas as well

But your reply to @algarkirk just reinforces their point - defence procurement, tattoo removal, IVF are all tiny nibbles.

If the country was to go down your suggested route, it would need to involve, say, revoking the right to free education entirely. That's the scale we're talking about.

Which is why I suspect the only answer is to muddle on through. Only not in the way Truss and Kwarteng want us to do so.

They know it's reckless and requires magical thinking to believe it'll pay for itself through higher growth. But they also know that "steady as she goes" through this energy crisis, fund the help package via a sensible mix of tax and borrowing, whilst being objectively the correct approach would deliver little political upside. It would leave the game unchanged when they need to kick the table over and force a new deck. Having done so they plan to frame the narrative over the next 2 years as New Era Low Tax Tories vs Same Old Labour Tax & Spenders. Come the GE, to be whispering these dirty words into the ears of the electorate - "Do you really want to pay more tax?"

This is the play, I think. They (Truss, the Tories) have to get their "low tax" mantle back - they can't win an election without that - and this is why they're cutting taxes when the country can’t afford it. It's not because they think it'll boost aspiration, investment and long term sustainable growth. They have no clue whether it'll do that and neither do they really care. They know you can’t audit these things anyway because it’s impossible to strip out causes and effects. And in political time there is no long term, there’s only the election. The reason they are cutting taxes is very simple and it is pure politics – it's so Labour have to say they’d raise them.

Me being a pretty frugal person

Living in reasonably energy efficient accommodation

Having a legacy “economy 10” leccy meter, which gives me cheap time between 2-5pm, 9-11pm & 1-6am

My supplier going bust and being transferred to shell, who have put me on their economy 7 tariff.

The government capping energy prices

Shell choosing to up the “day” rate, but leave the “night” rate mostly unchanged.

The government giving me £400 credit.

= my total energy bill, this year, is projected to be….. £185.

£15.41 per month.

Bonkers.

The biggest change that ought to be made is public sector pensions switching from to db to dc and a cap on what the employer contributes. Currently employer contributions average about 20% in the public sector. Yes wouldn't help immediately but in the long term it would. I would also do a clawback on state pensions so for every 5£ you get from other pensions you state pension is reduced by a pound

"Tory casino economics is gambling the mortgages and finances of every family in the country."

Labour will pull further ahead as the Government's plans unravel.

Julia Hartley-Brewer

@JuliaHB1

·

4h

I'm struggling with this "mini" Budget. I'm largely pro cutting taxes + smaller government, but millions of families and businesses desperately need help thanks to disastrous energy policy + lockdowns.

So why cut taxes for the rich - the only people who don't need the help?

https://twitter.com/JuliaHB1

At best it will prevent a serious recession.

How would drawdown be handled?

That's not to say they aren't worth doing, just that, if we were really having a conversation about the 'elephant in the room' - finding a way to properly fund that which we think is important enough to properly fund, and not doing the rest, we would need to be looking at an entirely dfferent scale.

Scotland already has an issue where lots of people get their free uni education in something like economics or accounting and then head south to London for the graduate job. It was only a last minute job offer + girlfriend that stopped me doing the same.

Scotland has a decent tax position because of O&G + Edinburgh finance, basically. The former is under real pressure at the mo (Aberdeen cheaper than Dundee!) and firms like Abrdn aren't doing great either. Future graduates similar to me (and companies) will head south in increasing numbers if there a long term difference in tax rates. It's much easier to do this than move from London to Frankfurt, for the Brexit comparison.

Spending here is higher than the UK average, hence the "Union dividend". This tax/spend divergence might make retiring to Scotland even more attractive than it already is (see the English populations in Moray, Highland, Orkney etc), further putting pressure on the public finances.

Most football supporters still largely support Labour (or the SNP outside of Rangers in Scotland), most Tory voters prefer rugby union or cricket.

It might help Truss a fraction in the redwall but given yesterday's mini budget her target is now more holding the bluewall anyway

Another reminder that the government’s fiscal policy risks fuelling inflation.

https://twitter.com/PaulBrandITV/status/1573624635966558208

Of course, those riding around in Government limos don't have to worry about the cost of filling their tanks up.

He's a very smart guy. I'm sure as a Conservative he only raised taxes because TINA told him he had to. Truss and her Chancellor think there is an alternative. If they are wrong, we are going to be having top rates of income tax north of 50% - and a flight of the rich out the country.

I would like to hear Truss say that she has reduced tax to draw in the wealthy from around the world. I have no problems with them coming here so long as they pay our modest taxes. Thousands more billionaires moving here is frankly the only way to get the NHS funded to the levels it needs to remain free at the point of use. We may have to hold our noses about the nature of some of these folk and how they have made their billions. But as long as they aren't involved in undermining the country, I can live with that.

As to the taxpayers of the future there arent enough ivf babies to be more than a rounding blip in the tax payer pool. You also neglect the opportunity cost if they adopt instead as children raised in care statistically underperform in later life compared to children raised in a family

https://www.abcivf.co.uk/costs?gclid=Cj0KCQjw1bqZBhDXARIsANTjCPKNd0DOc2KRCD89vlsGLfweOv_-P9Ew2o9wPrzw3FvWb16OWZ3UiwAaAlzBEALw_wcB

https://www.hfea.gov.uk/about-us/news-and-press-releases/2021-news-and-press-releases/ivf-cycles-surpass-1-million-and-uk-fertility-treatment-is-more-successful-than-ever/#:~:text=Over 1.3 million IVF cycles,figures from the HFEA show.

a mere extra 390,000 tax payers from 31 years of ivf...a blip as I said

What we'll actually get is a couple of years of Labour flailing about as it's consumed by the enormity of cleaning up the mess, followed by yet more of the Tories carving up the nation's remaining assets and distributing them to the already minted.

Tories out, Labour in, before the country caves in.

Youre basically telling a pensioner on average UK income youre taking 6 grand a year off them, the equivalent of increasing basic rate on an average earner in work to over 45%.

Instead smaller parties like the LDs, Greens and RefUK and SNP would normally hold the balance of power

HMRC already knows how much pensioners get in total as it taxes them above a certain figure so no tax returns required. Landlords also get taxed pensioner or not.

How do you get to taking 6K off them....for that level of clawback they would need additional income over the state pension of 30K or 35k if you give them the first 5K free of clawback. In my book someone with additional income of 30K doesnt need the state pension

And, of course, extending the additional tax to 3p in the £1.00 will not do much for the attractiveness of Scotland for high earners, either.

The US has a considerably bigger deficit than the UK, but the Fed is jacking up rates by 0.75% a go while the BoE aren't.

PR is no guarantor against the capture of the entire political system by loonies, but it would certainly make it a lot less probable.

The way things are going, they'll only be antedating its disorganised collapse by a few months anyway.

https://euromaidanpress.com/2022/09/24/president-of-the-world-mongol-federation-says-mongolia-welcomes-everybody-fleeing-mobilization-in-russia-especially-disproportionately-targeted-mongols/

Given the security situation a degree of dollar strength is inevitable but the Bank could and should have done more earlier and this week to stop us importing yet more inflation.

Someone earning 60,000 a year doesn't 'need' the personal allowance.

Why should a pensioner who planned his or her retirement fund some arse who earned 100k a year and pissed it all up the wall rather than saving? Why should income dependant pensioners suffer whilst asset rich ones laugh?

If State pension was lavish, perhaps, but its a pittance in return for a lifetime of work and tax.

I mean we might as well extend it and block access to NHS services for anybody on over average wage.

So having disbanded the armed forces and schools, we should have enough to fund the £87 billion due in interest on the national debt this year.

We will need further savings as next year the amount payable will be higher.

https://www.dw.com/en/spain-plans-temporary-wealth-tax-amid-high-inflation/a-63212575

"Spain's left-wing government has said it would slap a temporary tax on the wealthiest 1% of the country's population to help pay for inflation relief measures.

"We are talking about millionaires, those who are in the 1% of income," Finance Minister Maria Jesus Montero told Spanish laSexta television channel on Thursday.

She said it was important that "we can finance the aid" to support "the middle class and workers" but did not provide details on the tax rate or how much it would raise.

The government has introduced a raft of measures to help people cope with soaring prices, such as free public transport, stipends for students to stay in school and subsidized petrol.

The country's annual inflation rate hit 10.4% in August. It has remained in double digits since June, a level not seen since the mid-1980s."

You get state pension of 9k

You get additional income once the additional income is over 5k then for every 5£ you get state pension is reduced by £1

so additional income is 5k you get full state pension

at 10K additional you get 1K removed from state pension

at 20K additional you get 4k less state pension

so total for the 3 scenarios would be 14K, 18k,and 25K

https://www.bloomberg.com/news/articles/2022-09-23/financial-repression-may-become-necessary-to-contain-uk-yields

Under PR though the nationalist Sweden Democrats are now kingmakers in Sweden, the nationalist Meloni is likely to become PM in Italy tomorrow and in NZ the Greens or New Zealand First are often kingmakers. In Germany too the Greens are in power and the AfD growing in strength and in Spain the hard left Podemos are kingmakers with the populist right Vox gaining support

By that logic, people would always try to arrange their lives to maximise their income. Yet millions of people still choose to live in London and other parts of the south east, knowing full well that property prices mean that they would have much more disposable income if they lived elsewhere.

https://twitter.com/nazirafzal/status/1572560150715826177?s=21&t=sS7fzsUkqwXfeh_oTuiE3g

For a worker on 38,900 to lose an additional 5k of their income youd need to set basic rate at about 40% after the personal allowance

https://www.bbc.co.uk/news/entertainment-arts-63019250

I wonder how many Scottish bankers might choose to move from Edinburgh to Newcastle?

Sorry but you can't all bang on about pension time bombs, demographic pressure and underfunded services and yet any time someone suggests reducing the things we spend on or trying to save money you are all up in arms.

We either reduce spending or it all collapses. Yes that means some are going to lose out. Doing nothing is no longer an option.

There would be additional savings by abolishing the Ministry of defence too.

I would think it would also help, for example, software developers, who want to work for US firms, while living in the UK.