Punters now betting that Truss will be out next year – politicalbetting.com

Punters now betting that Truss will be out next year – politicalbetting.com

Punters now betting that Truss will be out next year – politicalbetting.com

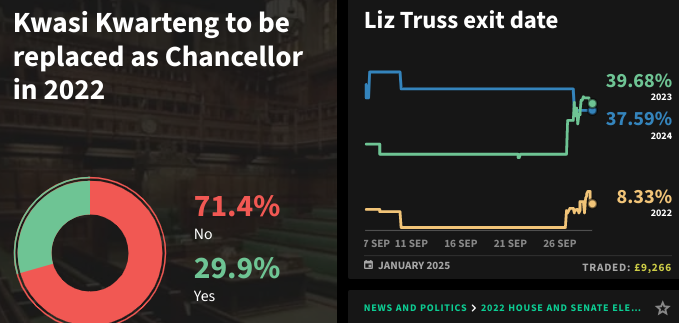

After just three weeks and two days in the job punters are making a 2023 departure for her the favourite in the Liz Truss exit betting. In another betting market, it is now a 29.9% chance that Chancellor Kwarteng will be out this year.

0

This discussion has been closed.

Comments

Incidentally, that fall is not from peak but from when they last sent a statement a few months ago, when it had already dropped £20,000 from the previous year.

I wonder how many other people approaching retirement are sitting on less than they imagine, and how many young and low-paid people are doing their nuts in their new compulsory workplace pensions.

Damn.

They should fire themselves for performing so poorly in Sterling terms.

The ‘handout program’ is an emergency measure; if you’re going to cap energy prices, it’s the only way to do it within a reasonable timeframe (ie right now). Coupling it with a program of tax cuts - promising growth but providing no justification for that other than the bare assertion - is what made it fiscally incredible. Tacking a tax cut only for the wealthiest on top of that made it political suicide.

“Regressive” is a red herring; you could address that through the tax system.

The basic problem is that any energy price cap that’s effective would be very expensive.

Now you could argue we shouldn’t have capped energy prices, but the economic fallout from that might well be equally severe.

What no politician has really been honest about is how much the spike in energy prices has cost us. As I’ve said before, it’s made the country significantly poorer, and the argument is really about how that pain is shared out. That we don’t know how long it might last makes it harder still. A new government isn’t going to change that.

If successive governments hadn’t put off decisions about nuclear and renewables for a decade or more while we relied on cheap imported gas, we’d be in a considerably better position.

And if course those needed investment are going to cost a great deal more to finance, now.

Government has only just published the details of the business cap - does it require a vote in Parliament ?

https://twitter.com/notayesmansecon/status/1575148896296357890

Next time will be harder, or not ?

The element of surprise is gone. On the other hard the expectation of intervention might calm things.

I imagine they would be rushed through.

ETA yes, they are friends and political allies but even so...

In the meantime, they'll enrich themselves (and curry favour with prospective new employers in the casino banking industry) with further rounds of tax cuts for the wealthy, paid for with cutting or simply terminating a whole raft of services and benefits for everybody else. Larceny on a truly Olympian scale, allied to a deliberate scorched Earth policy designed to make Labour's task of sorting out their bloody mess as hard as possible.

I've been capturing video from this webcam in Fort Myers all day and I've put it into a Timelapse. Check out the storm surge rushing in! Crazy.

https://twitter.com/WxBrenn/status/1575253395304288271

Perhaps?

My general mental model of British politicians is that they're smart people with good advice while the voters are less well informed and the media tries hard to make them dumber, and I *think* that's still mostly the right model, but whoa, it didn't work this time.

Incidentally, the big bank mortgage lenders are still advertising 5 year fixes some 300bps below swap curves. The likes of Lloyds, Barclays, Natwest. One would hope all the drama has encouraged people nearing the ends of their term to arrange an early remortgage. Of course in the final 3 mths it’s a simple login>click box>done. Earlier than that it’s an early repayment charge, which in the final year will be worth it in just about every case.

Let us see where base rates really peak at. It feels to me rather like economic reality is catching up with the world economy and the rates cycle will peak and turn far sooner than the Fed and markets expect. We’re having the recession that was supposed to happen before covid came along. Which of course caused a massive technical recession but because of the unprecedented global bail out, we didn’t see the economic adjustment mechanisms clicking into place to reset things.

I agree with an earlier poster, in the UK context Starmer will be coming to power at just the right time.

It is not exactly an impartial reporter, but keep reading what you want to believe...

https://www.bbc.co.uk/news/business-62939663

The problem seems to be dodgy companies obtaining deeds of assignment, claiming tax refunds, and not passing them over.

https://www.youtube.com/watch?v=LAbCsyjil4Y

Truss always came across as a cartoon neoliberal airhead in the Cameron years. I thought that this type of politician had been consigned to history after Brexit. But I was wrong about that. They are back, in power but based on no mandate and very little support for their policies, and too afraid (or arrogant) to call an election, and determined to cause chaos and misery through 'shock therapy' designed to address the irresponsibility of err.. their own, previous policies.

If they don't get rid of her, and they probably won't, this is potentially an extinction level event for the tories.

That's the problem.

Still, there are millions worse off than me.

I suspect they'd like to coronate Rishi or Wallace (which won't happen) but say they did you'd then have 50-60 kamikaze ex-Truss supporters on the backbenches sabotaging and scuppering anything the new new administration tried to do. And the majority in the House couldn't be guaranteed.

The Conservative Party really are in terrible trouble and the best thing for them now would be a GE and to go into opposition. Even better, for the kamikazes to be deselected or lose their seats as I don't think there's any other way to be rid of them.

Now that the disaster of this stupidity is unfolding they've spent the week headlining with other stories.

You can be right-of-centre and still be analytical and truthful. The Daily Telegraph today is particularly good (check out Jeremy Warner's piece).

The Daily Mail bears part of the blame for this crisis. Liz Truss was too weak or too stupid to stand up to them. She, and they, fed the membership what they wanted to hear. Something which bore no relation to the current economic or fiscal situation. A truthful tory campaign agenda would have promised tax cuts as soon as we can afford them, which isn't now.

They've stopped being the party of common sense. It is all desperately sad.

There's no coherent *system* of thought that says you should do this. There's only a *habit* of thought, which is kind of, believe things that you want to be true, and ignore or fire any annoying expert who says it won't work.

https://www.bbc.co.uk/news/blogs-the-papers-63069857

There is good journalism in UK titles: the FT, The Economist and there are good journalists that write for bad titles, but the overall atmosphere stinks, and not just in the absurd and pathetic propaganda of the Mail and Express.

The pension fund I am a trustee of has more than doubled its surplus on the back of improving gilt returns reducing our liabilities more rapidly than our assets. Although bad for everyone else this should have been a good news story for pension funds but the City came up with more "clever" financial engineering in the form of LDIs which caused yesterday's chaos.

Nice detail from the Ukrainian military's morning report:

On September 26, the Russian invaders sent to Lyman a column of seven tanks crewed by newly-mobilized men. They had no training to learn how to drive tanks or fire their weapons. Two of the tanks were in road accidents.

Tory MPs quickly realise May was a bad choice. Bad person. Bad policies. They remove May.

Tory MPs and then members select Boris.

Within a few years Tory MPs realise Boris was a bad choice. Bad person. Bad policies. They remove Boris.

Tory MPs choose Rishi but not decisively and members choose Truss. Within a few days of actual policies being enacted, Tory MPs realise Truss is a bad choice. Bad person. Bad policies.

There is a common thread. The problem isn't May. Or Johnson. Or Truss. The problem is the Conservative Party. It can no longer be trussted to chose leaders and thus Prime Ministers. Because time after time after time they select from their narrow pool and they chose mental.

If there was ever a red flag that a party needed time out of office to rethink who it is and what it is supposed to be doing, it is this now.

Utterly deranged.

https://twitter.com/welt/status/1575367053149708290

I think the near miss with pension funds will produce a chill in the hearts of many who didn't feel particularly vulnerable before - and a group who had been the Tories' core voters.

The problem though is that they have no democratic mandate, and any 'emergency' is one that it is absolutely clear to everyone that they have created themselves.

My guess is that a large part of the electorate won't buy it, and won't vote Conservative ever again. The tories can just become a pensioners/nimby lobbying group.

That’s quite clever of them.

I wonder how our favourite Nazi apologist would have explained that if he hadn’t got the ban hammer?

But, yes, it's easiest to do nothing. So that's what will probably happen.

My SIPP with vanguard is down but by a smaller amount.

How long have these LDI’s been around ?

I have two DB pots, one in the PPF. I need to check the other one. The funding of which had been improving due to stock market returns and pensioners dying off. The company ceased trading over 20 years ago.

The conservative party has sealed its fate and will be out of office for a long time

However, there are two issues here that need to be recognised

Starmer has endorsed the 19% tax rate and the abolition of the NI rise at a total cost of 20 billion, all borrowed money, and he has already allocated the other 2 billion of money raised from the reduction in the 45% rate again borrowed money which contradicts his demand to cancel the mini budget

Labour will be the next government but will be facing large tax rises and cuts in the public sector, but not just due to the idiotic behaviour of Kwarteng and Truss, but the worldwide rout in the bond markets causing financial mayhem across the globe

The fact is Russia invading Ukraine in an act of war which seems to have no end is going to make the west very much poorer and the strains will show for years, even decades

Starmer and labour will inherit a poisoned chalice and they will have extremely difficult decisions to make

Truss ain't done yet. The next step is her "supply side reforms" which consist of ripping up environmental, social and planning protections to allow her rapacious spiv friends to externalise all the costs and consequences of their greed onto other people, while trousered the profits. She sees this as the solution to the countries problem.

Shortly the Tories will be polling at Scottish levels in England too.

https://www.newstatesman.com/politics/2007/09/labour-majority-increase

Not a lot has happened since that was written.

“It was necessary for the chancellor to keep financial markets on-side, and I warned about the need for him to do this.” https://twitter.com/pmdfoster/status/1575364003731218432/photo/1

Cameron was a good PM IMO; he would have been a fairly steady hand in normal circumstances. May was less good, but hardly a 'bad person' (unless you have the odd view that all Conservatives are 'bad'). Boris is intelligent and ambitious, but has a lazy brain. Being a PM means hard work, and he was not willing to put in all the hours.

Truss might be the first of them *not* to be brought down by Brexit.

As long as the Europhobic loons are at the heart of the Conservative Party, they'll struggle. Europe has *never* been a massive problem for this country: we could succeed within or without the EU. But to the loons it became *THE* issue, above all the other structural issues in the country. It was a religion, a faith: "give us Brexit and everything will be fine."

F**k em. Chuck them all out, and all the preposterous sh*ts who supported them. Redwood. Jacob Rees-Worm. Bone. Cash. Patel. All the others.

We need a decent opposition, let alone government. And as long as their sick cancer lies at the heart of the Conservative Party, we'll never get it.

One cabinet minister told me the government had got the timing and sequencing wrong by announcing it while inflation was so high

https://www.thetimes.co.uk/article/cabinet-raises-doubts-as-calls-grow-for-u-turn-by-kwasi-kwarteng-w7k939283 https://twitter.com/MattChorley/status/1575373177114566656/photo/1

I hope that PR will be brought forward by the next government. Reform of the political system is required. I cannot see the circumstances in which I will vote Conservative again, because the Conservative party no longer believes in sound government.

Certainly Labour will inherit a poor financial position and have difficult decisions to make, but the 19% rate is not a particularly big problem.

Like Brexit

I understand that's brought about by a systemic rather than individual fund problem, but even so...

Nod wisely, murmur 'that's interesting,' but keep them away from the handles of power. Trump is an activist in his own way. So is Putin.

clear. 😏

In my opinion ruling out a Tory putsch is a mistake

I think we all need to recognise that the next labour government will be having to increase taxes and cut public spending in something that will be very difficult for them

Trump won the electoral college and that is still unfortunately how US presidents get elected. In the 21st century why not use the popular vote?

Boris won a majority of Conservative members, as did Truss. Maybe time for the Tories to let leaders 'emerge' again?

1. Even if the Truss reforms work, they will be bloody and brutal whilst they process through. I'm not sure the election is far enough away to wash said blood off the pavement before they would need to start canvassing for votes on it.

2. The two key takeouts the public have for this new version of the government is "unfair" and "incompetent". Working on the latter whilst delivering brutal and bloody reform is difficult.

3. But their real problem is "unfair". It appears they have barely got started on the unfairness, with massive spending cuts to be announced as a nice Christmas present. That their spiv mates will be getting fat off the profits - and sneering ministers saying why that is a good thing - is not going to be popular.

Much focus has been on "how do Labour win back those seats". But less on what feels like the more relevant question - "what if Tory voters disappear?"

Clearly Starmer and Labour are a step too far for some voters - though that may ease over time. But if Tories just say "I can't vote for that" and their vote collapses, we will see all kinds of crazy results wiping their MPs out.

Never say never in politics. Have we not learned that lesson repeatedly over the last decade?

Thank you for coming to my TED talk.

https://twitter.com/joshglancy/status/1575181803115008000

The thing to remember about Truss's Libdemmery is that she was a bonkers libertarian even then. Her views haven't really changed, she just chose a different vehicle.

They got margin calls, and the only way to find the ready cash to meet them was to sell some of their gilt holdings. As everyone was doing the same, and there were no buyers, prices

crashed.

Had the Bank not stepped in as the buyer of last resort, the downward spiral in gilt prices would have bankrupted several funds.

Dipstick.

The problem with Liz Truss is not that she does not have a personal mandate, as ours is not a presidential system, but that she seems intent on ripping up the 2019 manifesto on which she and the government were elected.

You are right. This could indeed be an extinction level event for the Conservative Party. Bets now boldly struck on a Labour Majority now may be looking distinctly overcautious by next week.

📻More of this on #TimesRadio from 10am

@MattChorley Did you tell him?

That doesn't mean he's wrong about Truss, of course. In fact, if even somebody as bonkers as him thought she was a bit weird, that was probably a warning sign.

Truss now 8 to go this year on Ladbrokes.

On Saturday she was 41 (46 with boost).

What absolute totally cretinous fools we all are

https://vf.politicalbetting.com/discussion/comment/3540915/#Comment_3540915

In my defence betting Con Most seats has been very much like owning Gilts.