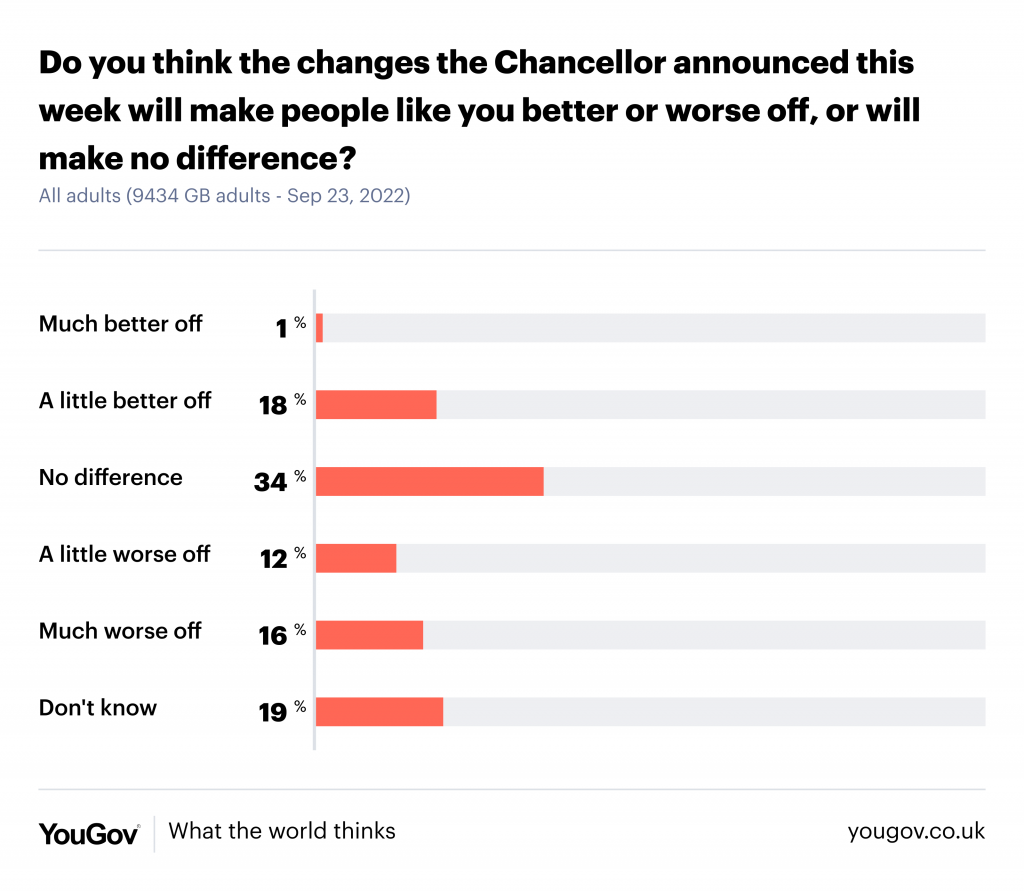

Just 19% think the Chancellor’s changes will make them better off – politicalbetting.com

Just 19% think the Chancellor’s changes will make them better off – politicalbetting.com

Just 19% think the Chancellor’s changes will make them better off – politicalbetting.com

One can I have learnt over the years of watching polls is that the initial reaction to budgets and other fiscal announcements not the one that will eventually be what the public will think.

0

This discussion has been closed.

Comments

"Bond yields, a measure of borrowing costs, shot higher, which will make the interest the government pays on the new debt it issues much more expensive. The yield on benchmark 10-year government bonds climbed to the highest since 2011. And the yield on the five-year bond rose by more than half a percentage point, to 4.15 percent, a huge move in a market where daily changes are typically measured in hundredths of a point."

“It’s fair to say that the gilt market hated today’s mini-budget,” Jim Leaviss, a bond investor at M&G Investments, said in emailed comments, referring to the market for British government bonds.

https://www.nytimes.com/2022/09/23/business/uk-government-pound-tax.html

https://twitter.com/peterwalker99/status/1573322949209251841

Seems to have settled around $1.09 for the time being tho.

By my reckoning this is now one of the top ten worst days for the pound (vs basket of other currencies) since 2004.

Not the league table the Chancellor would have wanted to join today… https://twitter.com/EdConwaySky/status/1573336169370497024/photo/1

If you have lower taxes, which leads to more growth, which leads to more revenues by taking a smaller slice of a bigger pie, then that is how the Laffer curve works past its peak.

What evidence do you have that the point of maximum revenue is probably much higher than current rates? And when current rates are at their highest in 74 years, and when under projections tax rates even after today's announcements will still be higher than in any of the past forty years before the pandemic, then just how high do you intend for taxes to get before we get out of problems economically?

If Starmer does manage to get into office at the next election then he won't be in power. He'll just flail about for a couple of years, drowning in the ditch that Truss has thrown him into, before being replaced by whatever malign creature (Braverman? Rees-Mogg?) that the Conservative selectorate chooses to foist upon us next. I don't see any way out of the death spiral right now.

Very detailed examination of the Ukrainian uap report, and it has issues.

BTW I was wrong, only one sighting is claimed to be from both telescopes simultaneously. So could be flies.

All this stuff from the Govt about taking a similar approach to borrowing as what the Govt did during Covid, rather ignores that that was supposed to be a one off that needed painful measures to compensate for, not building upon voluntarily!

If the tax changes encourage more people like your good self to be paying British taxes instead of Swiss, German, Singaporean or American taxes then that could boost revenues overall even while you benefit personally.

“The market is giving very strong signals that it is no longer willing to fund the UK’s external deficit position at the current configuration of UK real yields and exchange rate” - DB’s Saravelos

https://twitter.com/MehreenKhn/status/1573336570564050951

Brutal, utterly brutal. True though.

1)Remainers

2)People not believing in growth hard enough

3)Other people

https://twitter.com/Smithmichaelw/status/1573323517168427009?s=20&t=tzMg8_SALBtwE6LXEZxbww

https://twitter.com/lewis_goodall/status/1573324063266803716?s=20&t=kgaCA3fWp0OStC03r9N7Qw

https://twitter.com/thhamilton/status/1573253072402407424

For now.

Truss and KamiKwarteng couldn't even get that bit right- the booby traps are going to go off before they can leave the building.

Draft Sunak?

"My "theory" is that this group is out of funding, because of the war. So, why not set up a nice interesting thing that attracts people? I cannot prove this though."

Could GBP get to Dollar parity? That would certainly be interesting.

After today’s UK Budget’s Vat-free tourist shopping, for Irish person travelling to England…

1. iPhone 14 Pro

Ireland - €1,339

England - €980

2. MacBook Air M2

Ireland - €1,529

England - €1,170

Of which not a single penny will be made by the UK Government...

Are you disappointed in the reception to this budget among journos, with the markets and on PB? Oh, and the think tanks etc? Oh and the polling in the header.

I mean, stuff like the IFS judgement must sting, surely?

It reminds me of the Lib Dems and tuition fees.

https://www.youtube.com/watch?v=7b2T8K2D-ps

Once you deem a situation, however seemingly dire, to be an emergency needing extraordinary fiscal measures then you move the Overton window dramatically.

If you say Covid is a national emergency then you can say the NHS or the homeless or the railways or the cost of living crisis is a national emergency and go again on the fiscal splurging.

Could the last person to leave the UK please turn out the lights?

Why should workers in the UK accept that goods they have to pay full price for are much cheaper for wealthy tourists. And what's to stop Ireland doing the same for UK tourists. Now no country gets any revenue.

https://www.youtube.com/watch?v=YvGxZD-HNCM

Markets are now pricing in 5.5% interest rates from the @bankofengland next year.

Up from 4.75% yesterday.

Deutsche Bank saying BoE may need to table an emergency rate hike as soon as next week.

Extraordinary.

And, as I said yday, higher rates are a big, big deal.

Ugh. https://twitter.com/edconwaysky/status/1572975530722627584

There was certainly a case for a bold, growth oriented budget. But this looks as though they've blown all their firepower well wide of the target.

I genuinely hope I'm wrong.

The lesson I would take, a quest for growth can be a feast or famine journey, you need to reign in your own ideology and u turn on promises if there’s need to grow not shrink state and tax take, or need to forgo spending pledges when it’s overheating.

https://www.theatlantic.com/ideas/archive/2022/09/putin-speech-delay-ukraine-world-leaders/671495/

If an American president announced a major speech, booked the networks for 8 p.m., and then disappeared until the following morning, the analysis would be immediate and damning: chaos, disarray, indecision. The White House must be in crisis.

In the past 24 hours, this is exactly what happened in Moscow. The Russian president really did announce a major speech, alert state television, warn journalists, and then disappear without explanation. Although Vladimir Putin finally gave his speech to the nation this morning, the same conclusions have to apply: chaos, disarray, indecision. The Kremlin must be in crisis.

Sometime those that consider themselves clever can be really, really dumb.

I actually don’t remember a worse market response to a British budget, though my memory only goes back to the late 90s.

Today: BoE is going to have to increase interest rates again, this is terrible

I do question why some things that are in the emergency budget aren't just part of a main budget down the line though.

I think that having the temerity to grab for growth was always going to meet with a chorus of objection (and they must have known this) - so perhaps they just thought get the fruitier things out of the way now.

In many ways, the enterprise zones, the part we know least about, is the most interesting aspect of the budget. How will these interact with freeports - are they what Truss eventually believes in for the whole economy?

...“I’ve never known a government that has had so little support from its own backbenches, just four days sitting days in,” observed one MP.

The normally ebullient benches that roar behind a chancellor as they make a fiscal statement to the Commons were more hushed on Friday. Several present said few order papers were waved and there was only a smattering of comments of “hear, hear”, allegedly orchestrated by party whips.

“I completely despair, because I’m a member of a party that stands up for the squeezed middle not the very rich. This will be politically toxic and economically dubious,” said another MP present for the statement.

In a sign of the level of discontent, several Conservatives rose in the Commons chamber to aim barbed and hostile interventions at Kwarteng. Mel Stride, the chair of the Treasury select committee and former campaign manager for Rishi Sunak’s leadership bid, said there was a “vast void” in the mini-budget.

Stride criticised the Treasury’s refusal to publish fresh economic forecasts from the Office for Budget Responsibility based on the measures unveiled this week, saying the markets were getting “twitchy” and “now is the time for transparency” to “provide a calmness”...