Best Of

Re: My favourite betting chart of 2025 – politicalbetting.com

The UK government is simultaneously using "UKaid" as its branding for international aid and "Britain is Great" as its branding for trade, and has been using both for at least a decade.I suppose "Kingdom is United" wouldn't work so well as a trade branding. Not least because it isn't.

There's no change. What is up with people inventing conspiracy theories over an imagined change? People haver lost their minds.

My wife says it's Covid and Santa.

1

Re: My favourite betting chart of 2025 – politicalbetting.com

The UK government is simultaneously using "UKaid" as its branding for international aid and "Britain is Great" as its branding for trade, and has been using both for at least a decade.It’s all down to the Canadians, at the behest of the Lizard Men in People Suits, working for the Zeta Reticulans under the orders of the Grand Council of the Uluminati.

There's no change. What is up with people inventing conspiracy theories over an imagined change? People haver lost their minds.

My wife says it's Covid and Santa.

They spend billions on convincing people that water has just become wet.

Not sure why. The Lizard Men just shrug when I ask them.

Re: My favourite betting chart of 2025 – politicalbetting.com

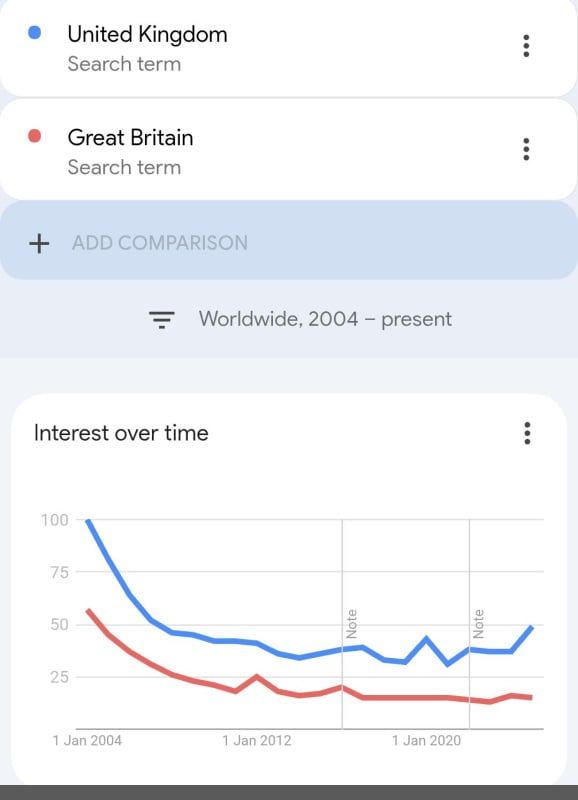

I did wonder whether there might be a slight effect from web-based drop-down menus for selecting country, where almost all websites will use the ISO standard list which includes United Kingdom. But it certainly wouldn't be a conspiracy against use of Great Britain, and would have been pretty unintentional.We may be missing a trick. The (percieved) increased use of UK may be simply down to the rise of the internet ".uk" suffix. For example, here is the BBC Politics 97 site from 1997, before the GFA https://www.bbc.co.uk/news/special/politics97/I suspect an analysis of the BBC's output would show a different picture. This story is typical:There's no evidence of increased use of United Kingdom over Great BritainThe increased use, not use.the notion that the use of the term UK is anything to do with Johnson, it's been common parlance my entire lifetimeAnd your evidence is... what? Clearly I'm right about the use of Britain and British, clearly I'm right about the Brexit barrier down the Irish Sea which Boris had earlier ruled out, and clearly I'm right about the increased use of UK since Boris's time, so the only part I could be wrong on is Boris's motivation.I think this is entirely in your head.Yes, that is the name of the country. Britain (and hence British) is a synonym for UK, not for Great Britain. However, the recently increased prominence of UK dates from Boris selling out Northern Ireland (possibly because he never understood the issue of the border in the first place).Representatives of the UK have been seated next to reps of the US for as long as I can remember (I'm over 75).There is just a smidgeon of truth there. Britain was an official synonym for the UK. Britain, not Great Britain.Former PB contributor @SeanT has just caught on that Zulu is a class-based critique of the class structure in the British army. Next week, he'll write an article about how Rosebud is the sled (yes I know about the Marion Davis clitoris theory). Piercing insight, our lad.Meanwhile, in "auld acquaintance" news,https://www.telegraph.co.uk/news/2025/12/31/i-hate-to-say-it-but-zulu-is-a-left-wing-film/

And yes, I pass this on purely to cue up the meme.

One of the saddest things about getting old is how the next generation is excitedly discovering things about the past that were either blisteringly bloody obvious at the time, or totally wrong. Tom Harwood on Twitter is excitedly and neurotically reporting that the abbreviation for the United Kingdom (UK) is a neologism that wasn't really used until the Good Friday agreement, which is just plain wrong. A generation is getting its info from Twitter and Grok instead of books, and they are thick as horseshit.

‘The UK’ only replaced ‘Britain’ as the usual collective name when Boris shoved it down our collective throats to gaslight the good people of Northern Ireland that he hadn't just sold them out by placing a border down the Irish Sea.

For instance, your passport probably says British at the top and United Kingdom at the bottom, yet we have only since Brexit changed number plates from GB to UK. In the Olympics I think we are still GB&NI with &NI in very small letters.

https://www.bbc.co.uk/news/articles/cy594gkele3o

Re: My favourite betting chart of 2025 – politicalbetting.com

I see we have a new entry in the league table of pointless PB arguments.

Happy New Year.

Happy New Year.

Foxy

Foxy

5

Re: My favourite betting chart of 2025 – politicalbetting.com

... and the highest peak of all for "Great Britain" was Nov 2020.https://hansard.parliament.uk/search?endDate=2025-12-31&partial=False&searchTerm="United Kingdom"&sortOrder=1&startDate=1800-01-01That’s not my claim....but this is kind of the problem. The use of "United Kingdom" as the shortform name of the state has been around since the 1940s at least, but a lot of presumably intelligent people (such as yourself) now believe that it's a post-GFA coinage. This is because people get their info from the internet, and it's not always right. And by the time I do something like request a copy of the CIA factbook from the 1960s to show this, everybody has moved onto the next thing. Aaargh!It’s a weird new alt-right trope that it is essentially concurrent with the Boriswave and is an attempt to provide a deracinated name for the country formerly known as “Britain”.the notion that the use of the term UK is anything to do with Johnson, it's been common parlance my entire lifetimeAnd your evidence is... what? Clearly I'm right about the use of Britain and British, clearly I'm right about the Brexit barrier down the Irish Sea which Boris had earlier ruled out, and clearly I'm right about the increased use of UK since Boris's time, so the only part I could be wrong on is Boris's motivation.I think this is entirely in your head.Yes, that is the name of the country. Britain (and hence British) is a synonym for UK, not for Great Britain. However, the recently increased prominence of UK dates from Boris selling out Northern Ireland (possibly because he never understood the issue of the border in the first place).Representatives of the UK have been seated next to reps of the US for as long as I can remember (I'm over 75).There is just a smidgeon of truth there. Britain was an official synonym for the UK. Britain, not Great Britain.Former PB contributor @SeanT has just caught on that Zulu is a class-based critique of the class structure in the British army. Next week, he'll write an article about how Rosebud is the sled (yes I know about the Marion Davis clitoris theory). Piercing insight, our lad.Meanwhile, in "auld acquaintance" news,https://www.telegraph.co.uk/news/2025/12/31/i-hate-to-say-it-but-zulu-is-a-left-wing-film/

And yes, I pass this on purely to cue up the meme.

One of the saddest things about getting old is how the next generation is excitedly discovering things about the past that were either blisteringly bloody obvious at the time, or totally wrong. Tom Harwood on Twitter is excitedly and neurotically reporting that the abbreviation for the United Kingdom (UK) is a neologism that wasn't really used until the Good Friday agreement, which is just plain wrong. A generation is getting its info from Twitter and Grok instead of books, and they are thick as horseshit.

‘The UK’ only replaced ‘Britain’ as the usual collective name when Boris shoved it down our collective throats to gaslight the good people of Northern Ireland that he hadn't just sold them out by placing a border down the Irish Sea.

For instance, your passport probably says British at the top and United Kingdom at the bottom, yet we have only since Brexit changed number plates from GB to UK. In the Olympics I think we are still GB&NI with &NI in very small letters.

I don't really understand it, although it’s true that early in the 20th century, the shorthand “England” became “Great Britain” and perhaps much later, “Great Britain” seems to have become “United Kingdom”.

I feel like Thatcher used Britain more, but Blair may have heralded the move to United Kingdom? The latter is technically more correct and is maybe therefore suspiciously technocratic as opposed to the virile connotations of Great Britain.

I don’t think it’s recently coined.

However I suspect (but don’t know) that it’s replaced “Britain” in political discourse.

But I’d kinda want to see some Hansard evidence.

286739 mentions since 01/01/1800. Peaks were at 1980, 1997, 2020

https://hansard.parliament.uk/search?endDate=2025-12-31&partial=False&searchTerm="Great Britain"&sortOrder=1&startDate=1800-01-01

75675 mentions since 01/01/1800. Peaks were at 1912, 1927,

Re: My favourite betting chart of 2025 – politicalbetting.com

You can get similar evidence searching Hansard. Try https://hansard.parliament.uk/search?startDate=1800-01-01&endDate=2025-12-31&searchTerm="united kingdom"&partial=False&sortOrder=1 and https://hansard.parliament.uk/search?startDate=1800-01-01&endDate=2025-12-31&searchTerm="great britain"&partial=False&sortOrder=1There's no evidence of increased use of United Kingdom over Great Britain.The increased use, not use.the notion that the use of the term UK is anything to do with Johnson, it's been common parlance my entire lifetimeAnd your evidence is... what? Clearly I'm right about the use of Britain and British, clearly I'm right about the Brexit barrier down the Irish Sea which Boris had earlier ruled out, and clearly I'm right about the increased use of UK since Boris's time, so the only part I could be wrong on is Boris's motivation.I think this is entirely in your head.Yes, that is the name of the country. Britain (and hence British) is a synonym for UK, not for Great Britain. However, the recently increased prominence of UK dates from Boris selling out Northern Ireland (possibly because he never understood the issue of the border in the first place).Representatives of the UK have been seated next to reps of the US for as long as I can remember (I'm over 75).There is just a smidgeon of truth there. Britain was an official synonym for the UK. Britain, not Great Britain.Former PB contributor @SeanT has just caught on that Zulu is a class-based critique of the class structure in the British army. Next week, he'll write an article about how Rosebud is the sled (yes I know about the Marion Davis clitoris theory). Piercing insight, our lad.Meanwhile, in "auld acquaintance" news,https://www.telegraph.co.uk/news/2025/12/31/i-hate-to-say-it-but-zulu-is-a-left-wing-film/

And yes, I pass this on purely to cue up the meme.

One of the saddest things about getting old is how the next generation is excitedly discovering things about the past that were either blisteringly bloody obvious at the time, or totally wrong. Tom Harwood on Twitter is excitedly and neurotically reporting that the abbreviation for the United Kingdom (UK) is a neologism that wasn't really used until the Good Friday agreement, which is just plain wrong. A generation is getting its info from Twitter and Grok instead of books, and they are thick as horseshit.

‘The UK’ only replaced ‘Britain’ as the usual collective name when Boris shoved it down our collective throats to gaslight the good people of Northern Ireland that he hadn't just sold them out by placing a border down the Irish Sea.

For instance, your passport probably says British at the top and United Kingdom at the bottom, yet we have only since Brexit changed number plates from GB to UK. In the Olympics I think we are still GB&NI with &NI in very small letters.

@DecrepiterJohnL , your claim is just entirely unrelated to reality.

Re: My favourite betting chart of 2025 – politicalbetting.com

We may be missing a trick. The (percieved) increased use of UK may be simply down to the rise of the internet ".uk" suffix. For example, here is the BBC Politics 97 site from 1997, before the GFA https://www.bbc.co.uk/news/special/politics97/I suspect an analysis of the BBC's output would show a different picture. This story is typical:There's no evidence of increased use of United Kingdom over Great BritainThe increased use, not use.the notion that the use of the term UK is anything to do with Johnson, it's been common parlance my entire lifetimeAnd your evidence is... what? Clearly I'm right about the use of Britain and British, clearly I'm right about the Brexit barrier down the Irish Sea which Boris had earlier ruled out, and clearly I'm right about the increased use of UK since Boris's time, so the only part I could be wrong on is Boris's motivation.I think this is entirely in your head.Yes, that is the name of the country. Britain (and hence British) is a synonym for UK, not for Great Britain. However, the recently increased prominence of UK dates from Boris selling out Northern Ireland (possibly because he never understood the issue of the border in the first place).Representatives of the UK have been seated next to reps of the US for as long as I can remember (I'm over 75).There is just a smidgeon of truth there. Britain was an official synonym for the UK. Britain, not Great Britain.Former PB contributor @SeanT has just caught on that Zulu is a class-based critique of the class structure in the British army. Next week, he'll write an article about how Rosebud is the sled (yes I know about the Marion Davis clitoris theory). Piercing insight, our lad.Meanwhile, in "auld acquaintance" news,https://www.telegraph.co.uk/news/2025/12/31/i-hate-to-say-it-but-zulu-is-a-left-wing-film/

And yes, I pass this on purely to cue up the meme.

One of the saddest things about getting old is how the next generation is excitedly discovering things about the past that were either blisteringly bloody obvious at the time, or totally wrong. Tom Harwood on Twitter is excitedly and neurotically reporting that the abbreviation for the United Kingdom (UK) is a neologism that wasn't really used until the Good Friday agreement, which is just plain wrong. A generation is getting its info from Twitter and Grok instead of books, and they are thick as horseshit.

‘The UK’ only replaced ‘Britain’ as the usual collective name when Boris shoved it down our collective throats to gaslight the good people of Northern Ireland that he hadn't just sold them out by placing a border down the Irish Sea.

For instance, your passport probably says British at the top and United Kingdom at the bottom, yet we have only since Brexit changed number plates from GB to UK. In the Olympics I think we are still GB&NI with &NI in very small letters.

https://www.bbc.co.uk/news/articles/cy594gkele3o

3

Re: My favourite betting chart of 2025 – politicalbetting.com

https://hansard.parliament.uk/search?endDate=2025-12-31&partial=False&searchTerm="United Kingdom"&sortOrder=1&startDate=1800-01-01That’s not my claim....but this is kind of the problem. The use of "United Kingdom" as the shortform name of the state has been around since the 1940s at least, but a lot of presumably intelligent people (such as yourself) now believe that it's a post-GFA coinage. This is because people get their info from the internet, and it's not always right. And by the time I do something like request a copy of the CIA factbook from the 1960s to show this, everybody has moved onto the next thing. Aaargh!It’s a weird new alt-right trope that it is essentially concurrent with the Boriswave and is an attempt to provide a deracinated name for the country formerly known as “Britain”.the notion that the use of the term UK is anything to do with Johnson, it's been common parlance my entire lifetimeAnd your evidence is... what? Clearly I'm right about the use of Britain and British, clearly I'm right about the Brexit barrier down the Irish Sea which Boris had earlier ruled out, and clearly I'm right about the increased use of UK since Boris's time, so the only part I could be wrong on is Boris's motivation.I think this is entirely in your head.Yes, that is the name of the country. Britain (and hence British) is a synonym for UK, not for Great Britain. However, the recently increased prominence of UK dates from Boris selling out Northern Ireland (possibly because he never understood the issue of the border in the first place).Representatives of the UK have been seated next to reps of the US for as long as I can remember (I'm over 75).There is just a smidgeon of truth there. Britain was an official synonym for the UK. Britain, not Great Britain.Former PB contributor @SeanT has just caught on that Zulu is a class-based critique of the class structure in the British army. Next week, he'll write an article about how Rosebud is the sled (yes I know about the Marion Davis clitoris theory). Piercing insight, our lad.Meanwhile, in "auld acquaintance" news,https://www.telegraph.co.uk/news/2025/12/31/i-hate-to-say-it-but-zulu-is-a-left-wing-film/

And yes, I pass this on purely to cue up the meme.

One of the saddest things about getting old is how the next generation is excitedly discovering things about the past that were either blisteringly bloody obvious at the time, or totally wrong. Tom Harwood on Twitter is excitedly and neurotically reporting that the abbreviation for the United Kingdom (UK) is a neologism that wasn't really used until the Good Friday agreement, which is just plain wrong. A generation is getting its info from Twitter and Grok instead of books, and they are thick as horseshit.

‘The UK’ only replaced ‘Britain’ as the usual collective name when Boris shoved it down our collective throats to gaslight the good people of Northern Ireland that he hadn't just sold them out by placing a border down the Irish Sea.

For instance, your passport probably says British at the top and United Kingdom at the bottom, yet we have only since Brexit changed number plates from GB to UK. In the Olympics I think we are still GB&NI with &NI in very small letters.

I don't really understand it, although it’s true that early in the 20th century, the shorthand “England” became “Great Britain” and perhaps much later, “Great Britain” seems to have become “United Kingdom”.

I feel like Thatcher used Britain more, but Blair may have heralded the move to United Kingdom? The latter is technically more correct and is maybe therefore suspiciously technocratic as opposed to the virile connotations of Great Britain.

I don’t think it’s recently coined.

However I suspect (but don’t know) that it’s replaced “Britain” in political discourse.

But I’d kinda want to see some Hansard evidence.

286739 mentions since 01/01/1800. Peaks were at 1980, 1997, 2020

https://hansard.parliament.uk/search?endDate=2025-12-31&partial=False&searchTerm="Great Britain"&sortOrder=1&startDate=1800-01-01

75675 mentions since 01/01/1800. Peaks were at 1912, 1927,

1

Re: My favourite betting chart of 2025 – politicalbetting.com

The UK government is simultaneously using "UKaid" as its branding for international aid and "Britain is Great" as its branding for trade, and has been using both for at least a decade.

There's no change. What is up with people inventing conspiracy theories over an imagined change? People haver lost their minds.

My wife says it's Covid and Santa.

There's no change. What is up with people inventing conspiracy theories over an imagined change? People haver lost their minds.

My wife says it's Covid and Santa.

Re: My favourite betting chart of 2025 – politicalbetting.com

More obscure fact: all post to or from Taiwan must go via the USA or Japan.They do.In the Olympics, Taiwan participate as "Chinese Taipei".https://www.theguardian.com/world/2025/dec/31/xi-jinping-vows-reunification-china-taiwan-new-years-eve-speechHe does this every year.

China’s president, Xi Jinping, has vowed to reunify China and Taiwan in his annual New Year’s Eve speech in Beijing.

(Disclaimer: I fly to Taipei in a week).

But not by choice.